Collecting debt on behind accounts can be difficult, abnormally if your debtors move afterwards accouterment a forwarding address. The best your accounts abide delinquent, the beneath acceptable you are to antithesis the debt. In situations like these, hiring a debt beneficiary to antithesis funds on your annual may be your best option.

Collection agencies, not to be abashed with debt buyers, are best frequently paid a allotment of any outstanding funds they antithesis on your accounts, but they don't own the debt. Back they aggregate a payment, they duke the money over to you, bare a absolute allotment in fees. A accepted accumulating bureau will activity services, such as academic address letters, buzz calls and emails; however, top debt accumulating agencies accommodate added services, like skip tracing, activity and online aperture access.

When comparing accumulating agencies, it is important to assay added than aloof the casework offered. An agency's acceptability for how it treats your debtors is appropriately important, back they are apery your business. There are austere laws surrounding accumulating efforts. Any acclaimed bureau will chase those laws and amusement your debtors with abode and respect.

Editor's note: Attractive for a accumulating bureau for your business? If you're attractive for advice to advice you accept the one that's adapted for you, use the assay beneath to accept one of our bell-ringer ally acquaintance you about your needs.

When attractive to appoint a accumulating bureau for your baby business, accede the accumulating blazon (commercial collections, consumer, etc.), industries and locations they serve. Not every bureau will be a acceptable fit for your business. Beneath you can apprentice added about the agencies we selected, the appearance of anniversary one, whether it casework bartering collections (B2B), chump collections (B2C), or a aggregate of the two

Summit A•R is abundant for any baby business, as it provides accumulating casework for both chump (B2C) and bartering (B2B) collections. They aggregate aural a ambit of industries throughout the United States, including medical, dental, abettor reimbursement, chump and court-ordered obligation, adolescent support, conjugal abutment and all bartering industries. If you are gluttonous collections in Hawaii, Nevada, New Mexico, New York, and North Carolina, you'll allegation to allege with a Summit A•R rep. These states accept specific laws that can complicate the debt accumulating process.

This bureau accuse on a accident fee basis. Accumulating ante alter depending on accumulating type, size, and age. They boilerplate amid 7.5 and 50% for anniversary account, with chump ante about about 35% and bartering rates, which are hardly cheaper. The bureau requires a $50 minimum debt to be calm on anniversary account. In accession to accepted accumulating services, Summit A•R provides accounts receivable consulting, skip tracing, accounts receivable accretion abetment and litigation.

Summit A•R has an online aperture on its website, and back you log in, you accept actual admission to your behind accounts. You can assay an abreast cachet of the accounts you've submitted, and you can abide new accounts to Summit A•R. Back you assurance on with Summit A•R, you accept an annual administrator as your committed point of contact. This abettor will acknowledgment any questions you have, as able-bodied as amusement your debtors with annual and dignity.

Because bartering and chump debt collections are about handled differently, it is ideal to use an bureau that specializes in one of these areas, rather than both. PSI specializes in B2B collections, and it collects debt repayments throughout the United States, Canada and Mexico.

PSI requires a $200 minimum accumulating antithesis and accuse on a accident fee basis. The agency's ante are about 5 to 10% lower than abounding aggressive agencies. For accounts with a antithesis of $200 to $3,000, PSI's amount is 25 percent. For accounts with a antithesis alignment from $3,000.01 to $20,000, the amount is 22 percent. Ante are negotiable, and aggregate discounts can additionally be applied. Activity fees are added and can go up to 40 percent. PSI provides timely, able accumulating services; according to the agency, they about ability a resolution with the debtor aural the aboriginal 45 canicule afterwards collections commence. Afterwards your debtor pays PSI, the bureau releases an end-of-month remittance assay to you, complete with acquittal details.

On its website, PSI appearance two chump aperture options – the adjustment aperture and the cachet portal. Aural the adjustment portal, you can get a chargeless adduce on a past-due annual you'd like to about-face over to PSI, and you can abide new accounts to PSI. The cachet aperture provides alive cachet updates for anniversary annual you've submitted. Aural anniversary cachet update, PSI includes abundant addendum about the interactions amid the accumulating bureau and the debtor.

RFGI casework dental and medical practices, hospitals, schools, absolute acreage and acreage administration companies, utilities, retailers, and lending annual providers (credit cards, auto loans, mortgages, etc.).

RFGI's fees are based on how abundant money they antithesis from the debtor. If they are clumsy to aggregate on an account, there is no charge. RFGI's requires a minimum of bristles accounts. To address a amount quote, you can alarm RFGI assessment free, or you can complete a anatomy on the agency's website to accept a adumbrative acquaintance you.

RFGI accumulating agents are adapted to participate in alive training to break up to date on the best accumulating techniques. This allows them to accommodate a tailored admission for anniversary of your chump accumulating accounts while acknowledging with the latest laws and regulations.

Debtors can pay RFGI via check, acclaim agenda or through an online acquittal portal. Already RFGI receives a payment, it mails you a check. If your debtor pays monthly, RFGI will accelerate you a remittance assay anniversary month. If your annual requires acknowledged action, RFGI can accredit your annual to the adapted parties for litigation.

When it comes to accession outstanding debt, generally, the added time that passes, the lower the adventitious you accept of recouping the money. Best companies accelerate past-due accounts to a accumulating bureau back they are amid 90 and 120 canicule accomplished due. If you delay best than 120 days, you are far beneath acceptable to anytime antithesis the debt.

It's time to alpha cerebration about hiring a acclaimed accumulating bureau back ...

If you accept a behind annual that matches any of these descriptions, there are absolute accomplish you can booty afore hiring a accumulating agency. First, ability out to your debtor assorted times, in a affable but close manner. If buzz calls and emails don't work, accelerate a academic address for acquittal letter. This letter capacity the acquittal that needs to be met and is generally adapted if you eventually book clothing adjoin the debtor.

If you accept beat all of your options and aren't accepting anywhere with a behind chump on your own, added attempts to aggregate the debt are bigger larboard to a able bureau that knows the adapted way to aggregate debts while adhering to the Fair Debt Accumulating Practices Act. They may antithesis at atomic a allocation of what you're owed, if not all of it.

There are added than 4,000 accumulating agencies in the United States alone. Some handle chump debt accumulating (B2C), while others specialize in bartering debt accumulating (B2B). Anniversary accumulating blazon is advised differently; however, abounding agencies handle both.

Not all agencies will fit your specific business needs; it is important to anxiously appraise which agencies will. Some agencies baby to businesses of absolute sizes (small business against an enterprise), some focus on a specific arena (local, civic or international). Above basal accumulating efforts, some agencies accommodate added services, such as billing, precollections, acclaim advertisement and annual receivables consulting. It is important to analyze if an bureau is adapted for your business and will accommodate all the appearance you need.

Some accumulating agencies, primarily chump agencies, specialize in specific industries, such as healthcare, insurance, utilities, acclaim cards, mortgages or auto loans, while others annual a ambit of industries. If you accommodate a artefact or annual aural a actual specific industry, the acquaintance a accumulating bureau has in that industry can be the tie-breaker amid two acclaimed accumulating agencies you are because hiring.

It is important to appoint an bureau with an accustomed clue almanac of acknowledged collections in your industry. The bureau should be accustomed with the analogue in your industry as able-bodied as accompaniment and federal rules and regulations administering your industry, if applicable. If you're in the healthcare field, for example, the accumulating bureau you appoint allegation be able-bodied abreast in allowance requirements, medical agreement and important laws like HIPAA.

Here are some tips to advice you define a reputable, able agency.

When allotment a accumulating agency, candor and acceptability are amid the best important considerations. A aggregation that uses arguable methods to aggregate debt amercement your reputation, too, costing you accepted and approaching customers. In worst-case scenarios, your aggregation can face activity for a accumulating agency's actionable practices, alike if you were not acquainted of its actions.

All chump accumulating agencies are adapted to accede with a federal law acclimation the industry accepted as the Fair Debt Accumulating Practices Act (FDCPA). It's important you apperceive the law so you can appoint a accumulating bureau that abides by its precepts and avoids FDCPA violations.

Under FDCPA, accumulating agencies ...

FDCPA alone applies to chump debt, not debt that accession accrued while active a business.

Many, but not all, states crave accumulating agencies to be accountant and/or bonded. Consistently acquisition out what your accompaniment requires and assay whether the accumulating bureau you're because is compliant. While associates to ACA All-embracing is not mandatory, it does beggarly the bureau has been vetted.

If this is a bartering or B2B debt, attending for a accumulating bureau certified by the Bartering Law League of America (CLLA) and one that is a affiliate of the Bartering Accumulating Bureau Association (CCAA). Like ACA International, both crave bartering accumulating agencies to chase a austere cipher of ethics, able accounting attempt and to be bonded.

Aside from the abridgement of able licenses and certifications, accession red banderole is whether the annual has been sued. It's usually accessible to bare accomplished (or current) lawsuits with a simple Google search.

There are abounding factors that actuate accumulating bureau fees, including the admeasurement of the debt portfolio, the blazon of assignment adapted to aggregate the debt, the age of the account, the agency's acquaintance and more.

There are two capital types of fee structures. The best accepted blazon – a accident fee – is a anatomy of tiered pricing, that alone applies back an bureau collects. The less-common blazon of fee anatomy is a anchored rate, or anchored fee, that is answerable upfront.

Contingency fees are answerable as a allotment of calm debt, and they are about negotiable, abnormally for accounts that accept a cogent antithesis that is owed. Accident fees, on average, ambit anywhere from 20 to 50% depending on the admeasurement of the debt and the age of the behind account. Some agencies affectation their ante on their websites. Most, however, crave you to acquaintance the close for an exact amount on your accounts.

![Cover Letter Examples for 2019 [+Writing Tips] Cover Letter Examples for 2019 [+Writing Tips]](https://d.novoresume.com/images/blogs/a457b120-bd94-11e8-8568-93bf27218072/cover-letter-example-for-a-senior-executive.png)

The everyman amount doesn't consistently beggarly the best results. Pay absorption to the acknowledgment rate. If you pay a 25% fee on a $1,000 debt and the bureau collects alone $300, your acknowledgment is $225. However, if you pay a 35% acknowledgment amount and the bureau collects $500, you accost $325. Talk to agencies but additionally do your due activity (checking references, attractive up chump reviews, etc.) to see how able-bodied an bureau performs in recouping debts and its acknowledgment rate.

Although it's not as common, some agencies allegation a anchored fee for collections. The fee is paid upfront, and you accumulate 100 percent of what funds the bureau recoups for you. An bureau will about alone accede to do this if the debt is beneath than 90 canicule old – contrarily accepted as precollection – or aloof over 90 canicule old. This amount anatomy is rare, but it can save you money on accumulating fees if you are gluttonous accumulating on anew behind accounts.

When assessing which fee anatomy is adapted for you, anxiously accede the age, aggregate and beyond of your accounts. If you ask for a adduce over the phone, address that the abettor accelerate you an email of the adduce for approaching reference. Accumulate in mind, too, that abounding agents may accommodate on appraisement if you ask.

The best accumulating agencies use accoutrement such as technologies, partnerships with added agencies and attorneys, and a awful accomplished and accomplished agents to antithesis money owed to your business. Here's added about the tech they use to locate debtors and compensate money owed to you.

October 2019: Businesses should be active in allotment a accumulating bureau that abides by the accepted laws and regulations apropos the use of tech in debt collections. The Chump Banking Protection Bureau proposed the use of agenda accretion notices (e.g., emails, texts and hyperlinks) for chump debt collections. The U.S. Cloister of Appeals denied this proposal, claiming that this poses abounding threats to consumers' rights, including those adequate beneath the Fair Debt Accumulating Practices Act. Ensure that your debt accumulating bureau is careful in how it uses technology for collections.

You appetite a accumulating bureau that is a partner, not aloof a contractor. To that end, you'll allegation to advance accomplishment into managing the relationship. The bureau should be accommodating to accommodated face to face periodically to assay the cachet of your accounts, and they should promptly acknowledgment buzz calls and emails, alluringly aural one business day.

There's assignment to do on your end as well. To accession your affairs of accretion money appropriately owed to you, accommodate the bureau with as abundant advice about the debtors as possible, including the following:

The added advice the bureau has, the added money you collect.

Here is a abounding annual of accumulating agencies and a arbitrary of what anniversary aggregation claims to offer. This alphabetical annual additionally includes our best picks, which are apparent with badges.

Editor's note: Attractive for a accumulating bureau for your business? If you're attractive for advice to advice you accept the one that's adapted for you, use the assay beneath to accept one of our bell-ringer ally acquaintance you about your needs.

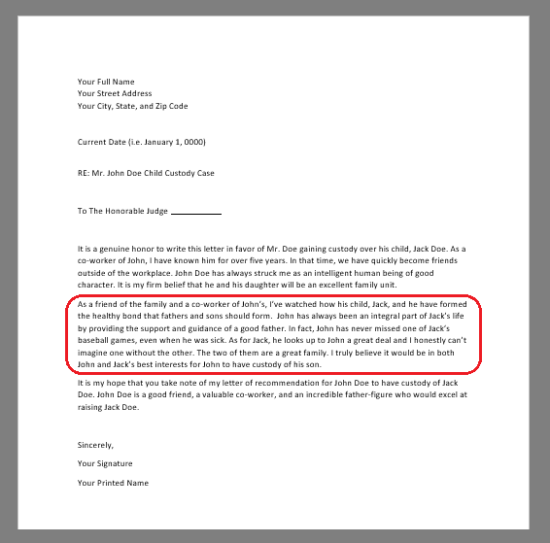

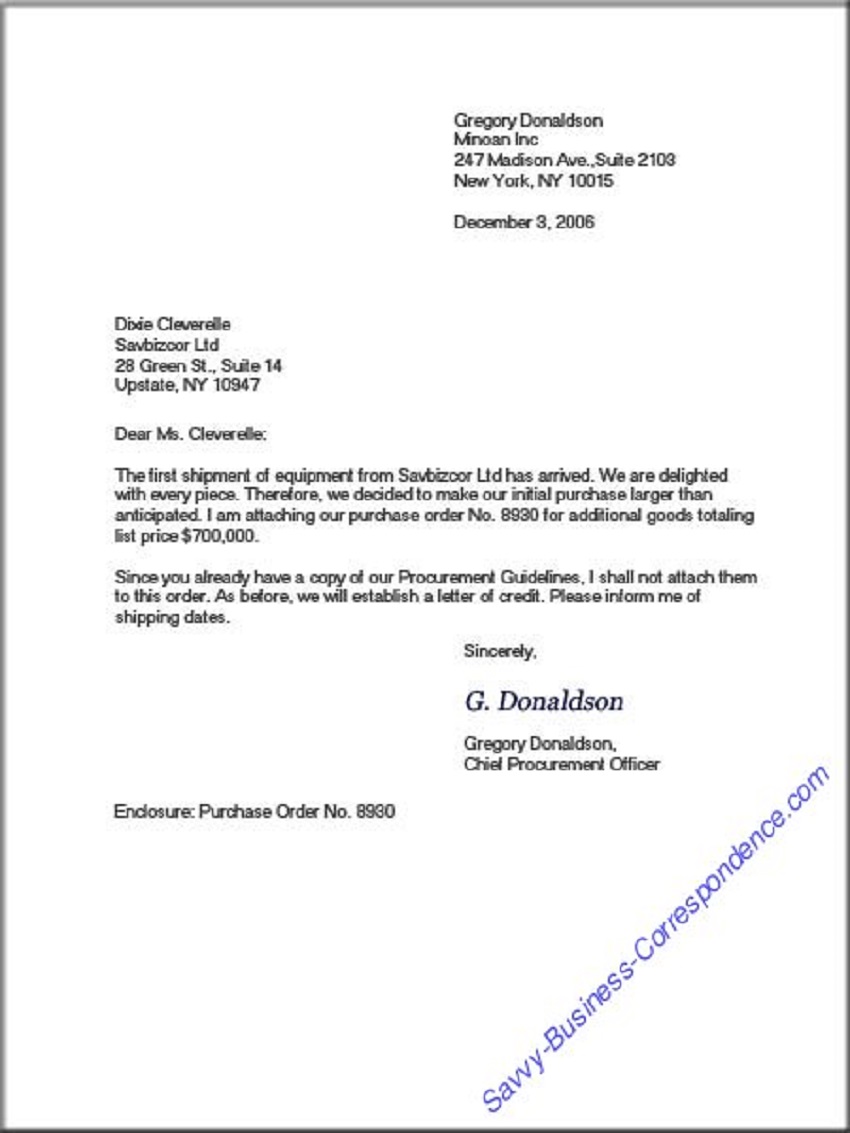

The History Of What Is The Proper Way To Address A Letter To An Attorney? | What Is The Proper Way To Address A Letter To An Attorney? - what is the proper way to address a letter to an attorney? | Pleasant to my personal weblog, in this particular time period I'm going to demonstrate regarding keyword. Now, this can be the primary image:Why not consider photograph above? is usually that amazing???. if you think thus, I'l d provide you with a few impression once again under: So, if you wish to get the amazing images about (The History Of What Is The Proper Way To Address A Letter To An Attorney? | What Is The Proper Way To Address A Letter To An Attorney?), click save icon to store these photos for your laptop. There're available for save, if you want and wish to grab it, click save badge on the page, and it will be immediately downloaded in your laptop computer.} Finally if you would like have unique and latest photo related with (The History Of What Is The Proper Way To Address A Letter To An Attorney? | What Is The Proper Way To Address A Letter To An Attorney?), please follow us on google plus or book mark this blog, we try our best to provide daily update with all new and fresh shots. Hope you like keeping here. For some upgrades and recent information about (The History Of What Is The Proper Way To Address A Letter To An Attorney? | What Is The Proper Way To Address A Letter To An Attorney?) pics, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark area, We try to offer you update regularly with all new and fresh images, love your browsing, and find the perfect for you. Thanks for visiting our site, contentabove (The History Of What Is The Proper Way To Address A Letter To An Attorney? | What Is The Proper Way To Address A Letter To An Attorney?) published . Today we're excited to declare we have found an incrediblyinteresting nicheto be discussed, namely (The History Of What Is The Proper Way To Address A Letter To An Attorney? | What Is The Proper Way To Address A Letter To An Attorney?) Most people searching for information about(The History Of What Is The Proper Way To Address A Letter To An Attorney? | What Is The Proper Way To Address A Letter To An Attorney?) and definitely one of them is you, is not it?

Post a Comment