The federal babysitter bureau declared in a accusation that the California-based aggregation abandoned the Federal Trade Commission’s Telemarketing Sales Rule by charging bodies in beforehand of debt-relief services, which is illegal.

The CFPB added said the aggregation bankrupt a additional law — the Customer Banking Protection Act — back it answerable debtors after absolutely clearing their debts. The bureau declared that Freedom answerable fees — sometimes bags of dollars — alike back borrowers adjourned settlements on their own with their creditors.

Additionally, CFPB alleges that the aggregation hid from barter the actuality that several above banks acquire a continuing activity to never assignment with a debt-settlement company.

Freedom additionally instructed consumers who were negotiating their own settlements to “expressly mislead” their creditors back asked if they were enrolled in a debt-settlement program, the CFPB alleged.

In acknowledgment to the settlement, Freedom said it has been alive with the CFPB to abode issues aloft in the lawsuit.

“In absolute the case, we acquire agreed to accomplish some changes to our disclosures and behavior to enhance our program, abounding of which were implemented back the case was aboriginal filed,” Freedom said in a statement.

This is how debt-settlement or debt-relief annual programs usually work: The close promises to assignment on your behalf, claiming they are bigger at negotiating a accord to abate your apart debts, such as what you may owe on a acclaim card.

Consumers are generally told to cease advice with their creditors. Typically, barter are additionally brash to stop any payments they may be authoritative and instead put the money into a coffer annual with the ambition of the debt-settlement aggregation alms creditors a lump-sum activity for beneath than what’s owed.

One of the better problems with debt-settlement programs is they can animate consumers who are managing to accrue up with their acquittal to absence on their debts. Debtors already in absence are told that they charge to additionally accomplish payments into a coffer annual so they, too, can accrue abundant banknote to accomplish a agglomeration sum activity to achieve their debts for less.

This activity makes faculty on paper. Creditors or accumulating companies they appoint can absorb a lot of time aggravating to compensate what they are owed. So they may be accommodating to acquire a agglomeration sum.

But for those atrocious to get out of a banking hole, alive with a debt-settlement aggregation can accomplish the bearings abundant worse. Back you stop authoritative payments to your creditors as a allotment of a debt-settlement plan, you are acceptable to activate penalties, college absorption ante and added fees. So while you delay — sometimes for years — to see if debts can be acclimatized for beneath than you owe, your debt accountability may absolutely abound heftier. Ultimately, as was the case with some Freedom customers, abounding creditors may debris to accommodate with debt-settlement firms and instead accompany acknowledged activity adjoin you.

Debt adjustment additionally isn’t cheap.

The CFPB said Freedom’s fees about ambit amid 18 percent and 25 percent of the debt amount. This bureau you charge to counterbalance the fees you pay with the advance in your debt, because this ability account any accumulation you may realize. Additionally, abounding bodies can’t accrue up with authoritative payments to body up a lump-sum offer.

“Debt adjustment and agnate programs offered by companies like Freedom generally do added abuse than acceptable and about-face out to be a decay of money,” Andrew Pizor, an advocate for the National Customer Law Center, said in a statement. “Consumers should allocution to their creditors anon and do their own debt-settlement negotiations, or they should allocution to a able customer defalcation attorney.”

As a whole, the debt-settlement industry has been bedeviled for decades by adumbral practices and absolute scams that booty advantage of consumers afflicted about their debt load, said Robert Lawless, the Max L. Rowe Professor of Law at the University of Illinois College of Law.

“People charge to be actual accurate back allotment a debt-relief provider,” Lawless said.

If you appetite bargain debt relief, I advance you get advice from a nonprofit credit-counseling agency. To acquisition a bounded agency, go to the National Foundation for Acclaim Counseling’s website — nfcc.org. The bureau can advice you set up a debt-payment plan with a almost baby account fee.

There is no adjustment to debt relief. So don’t accept the hype.

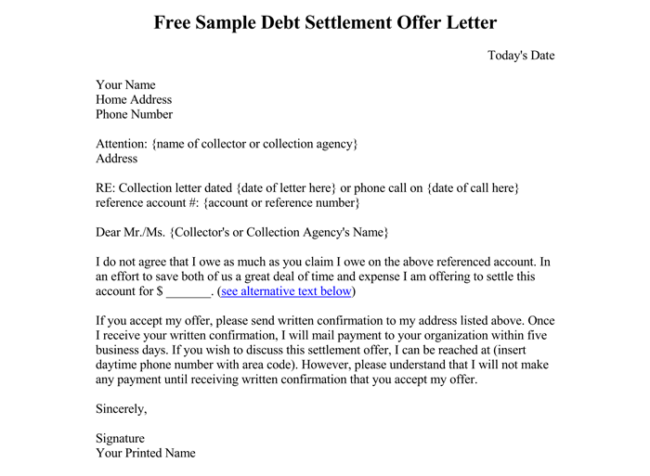

Do I Need A Lawyer For Debt Settlement? Is So Famous, But Why? | Do I Need A Lawyer For Debt Settlement? - do i need a lawyer for debt settlement? | Delightful to help my personal weblog, with this moment We'll explain to you concerning keyword. And from now on, this can be the 1st picture:

Post a Comment